By: Sofia Esparza

It was 5:40 a.m. and the sky had begun to turn orange when I unlocked my bike. I put an airpod in my right ear, pressed play on a rap playlist, and started pedaling for the three-mile uphill ride to work.

Another 40-hour work week was ahead. By the time I started my 6 a.m. shift as a rental desk assistant at the University of Minnesota’s Fleet Services Facility, the campus vehicle rental, I was drenched in sweat and out of breath.

That was last summer, before I bought my first car. I’m used to working: I worked during high school, and I hold down a full-time job while at the university, but six miles of biking in addition to my eight-hour shift was just too much. Even for me.

The National Center for Education Statistics said that as of 2020, only 10% of full-time college students worked more than 35 hours per week. Forty percent of full-time students are unemployed.

On my 14th birthday, I applied for my first job. It was at a Culver’s restaurant in my neighborhood in Eau Claire, Wisconsin. I worked 18 hours a week, the legal maximum for children under 16. Being the only eighth grader to request time off for amateur after-school volleyball games was embarrassing.

Through high school, I worked two jobs. The longest I worked without a day off was 15 days. The money I made went to college savings or my phone bill, but most went toward funding my club volleyball, which I played year-round and proudly paid for myself.

However, when I committed to the University of Minnesota, nothing could’ve prepared me for the financial burden that came along with pursuing a four-year degree. As a first-generation college student, I had no background and little guidance for important financial decisions about student loans. My high school savings were gone by the first semester. I had no choice but to take out federal and private student loans if I wanted to continue my education.

One in four U.S. adults under 40 have student loan debt, according to the Pew Research Center. My dad cosigned my loans because I wasn’t approved on my own and my bachelor’s degree depended on it. While I calculated what my future repayment plans would look like, student loan debt became a divisive political issue during the Biden presidency. My dad still hopes that promises of student loan forgiveness come to fruition.

I frequently worry about how my student debt will affect my future. Will the demands of a loan repayment schedule decide my choice of career? I already struggle with the low wages offered for internship positions. I can’t help but feel that college is harder for low-income students like myself, who have to prioritize paying bills over gaining relevant job experience.

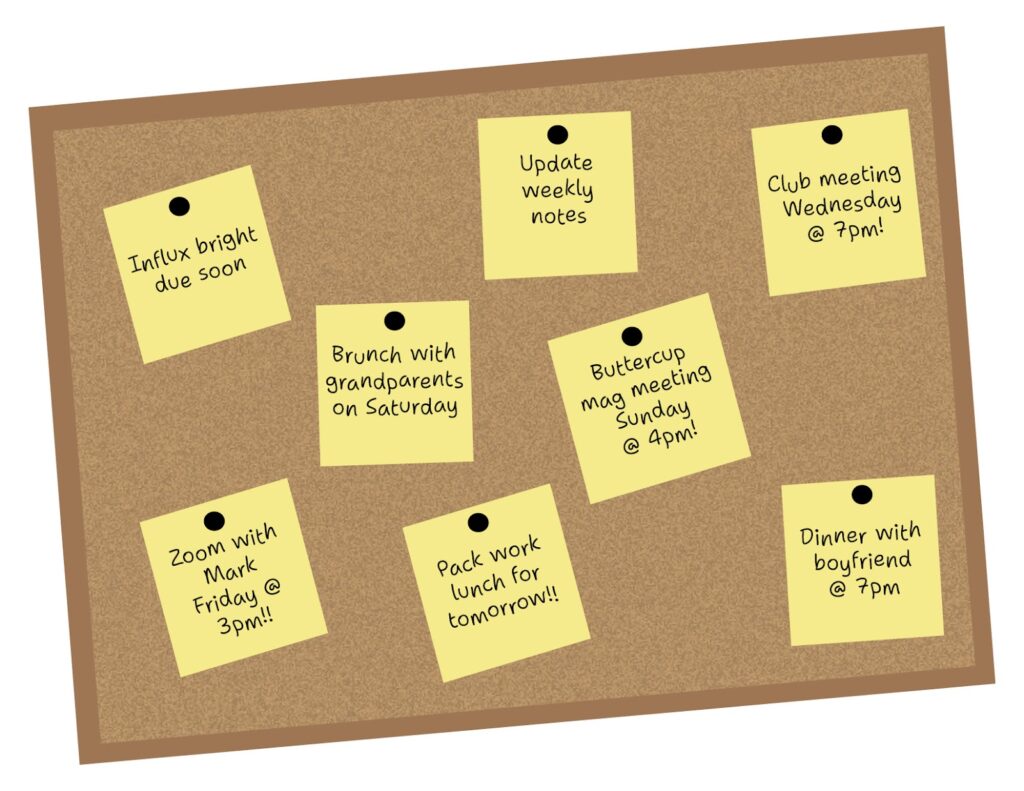

As a junior in college, I work six days a week. Apart from my leadership responsibilities in two student magazines, I balance my desk job at the university with a part-time leasing consultant gig at my apartment complex. I was struggling to keep up with rent payments so the housing discount it offers took some pressure off.

Now, I work five steady 6 a.m. – 2 p.m. shifts during the work week, a rare schedule for a college student trying to keep up with the demands of extracurricular activities, job hunting and a social life.

When I stare at myself in the mirror in the early hours before work, I see the exhaustion underneath my eyes. I think about how lucky my roommates are to stay sleeping while I splash my face with cold water. I think about how they’ll all get ready for the day together and try to calm my fear of missing out.

I struggle with the fact that my college experience looks entirely different from that of my friends. I had dreams of studying abroad, spending hours in the library between classes and waking up after sunrise to a slow morning with an iced latte.

The physical toll of working full-time as a student is draining. I average five hours of sleep. When I’m not working, I want to rest, making it difficult to find the energy to do homework. I still think about how my legs would ache in the evenings when I was biking to work.

“Be a shark,” my father always said. “Hard work will be rewarded.” I grew up watching him work 12-hour overnight shifts at the local Nestle factory. As a Mexican immigrant in a country where immigration is perhaps the most divisive political issue of all, he’s the hardest worker I know and my source of strength. He taught me to use every opportunity to my advantage and to see the value in paying for school myself.

It’s a constant battle between wishing my situation was different, and being grateful for my life as is. I wish my parents could afford to help me through school, but my seven siblings depend on them. I wish I had been smarter about applying for financial aid as a freshman. I wish I didn’t have to watch my friends leave for late-night bonfires and dinners while I pack my lunch for my shift the next morning and get ready for bed.

However, I do find satisfaction in being productive. It feels almost fear-based: I worry that I’ll miss out on opportunities if I’m not working as hard as I possibly can. My desire to make my bachelor’s degree and my parent’s sacrifices worth it weighs on me. They envisioned a better future for their kids and working this hard is the only way I’ve known to achieve it.

I get to attend college, unlike my parents. I have a job that pays me well. I have a roof over my head and I can afford to pay my rent on time. I have a higher income than my mother.

Working 40 hours a week as a full-time student is far from ideal. But it isn’t terrible. It’s a unique experience, one that only a fraction of students go through. My college experience may look different, but I like to think it gives me a competitive edge. After all, the early bird gets the worm.